The Ultimate Guide to Tendering in 2020

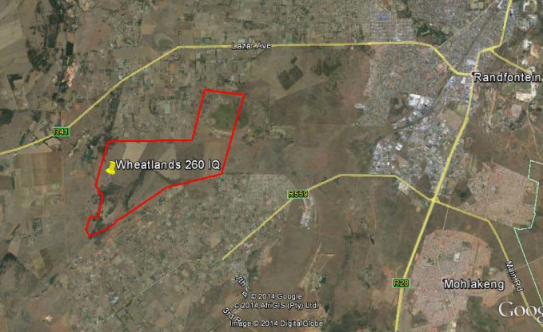

Tenders in South Africa can be a lucrative source of income for small businesses. They can, however, be challenging to negotiate, especially since so much legislation has changed, and the requirements differ so drastically between organisations and government sectors. Adding to this, some Departments or Municipalities have existing relationships with companies that already perform really well and that have been winning tenders for long periods. Getting your foot in the door means getting the process right from the beginning. This will not only save you time and effort but has the potential to set up those all-important income streams and boost your cash flow.

Let’s cover the groundwork together, so your business is not only equipped for success but set to impress.

Forgive the obvious, but first:

What is a Tender?

A tender is an offer to do work or supply goods at a fixed price. The tender or procurement process is designed to ensure that the work to be done is distributed fairly. In fact, there are procurement policies that are used as a framework on how to make decisions on which tenders or bids to accept. Although the price is a highly competitive factor driving the decision on which tender or bid to accept, it is not the only factor taken into consideration.

When a client entity accepts a tender, it becomes a binding business contract on and for both parties. In layman’s terms, it means that the individual(s) or company that won this business opportunity have to provide the goods or services in the way they agreed to and, at the price they offered it, and the client entity must pay the agreed price at the agreed time.

Make sure that you can meet all the requirements within the specified time and can honour your offer if your bid is successful.

| Do not make any misrepresentations or false statements in your bid documentation. Since it is a legal document and therefore enforceable by law.

In the event you don’t secure the tender this time around, the process of writing a tender can help your business by clarifying your business objectives, and evaluate your strengths and weaknesses.

By taking it a step further and asking for feedback on your tender document, you will raise your profile with the prospective client /company and help your business learn more accurately about the client’s needs. |

|

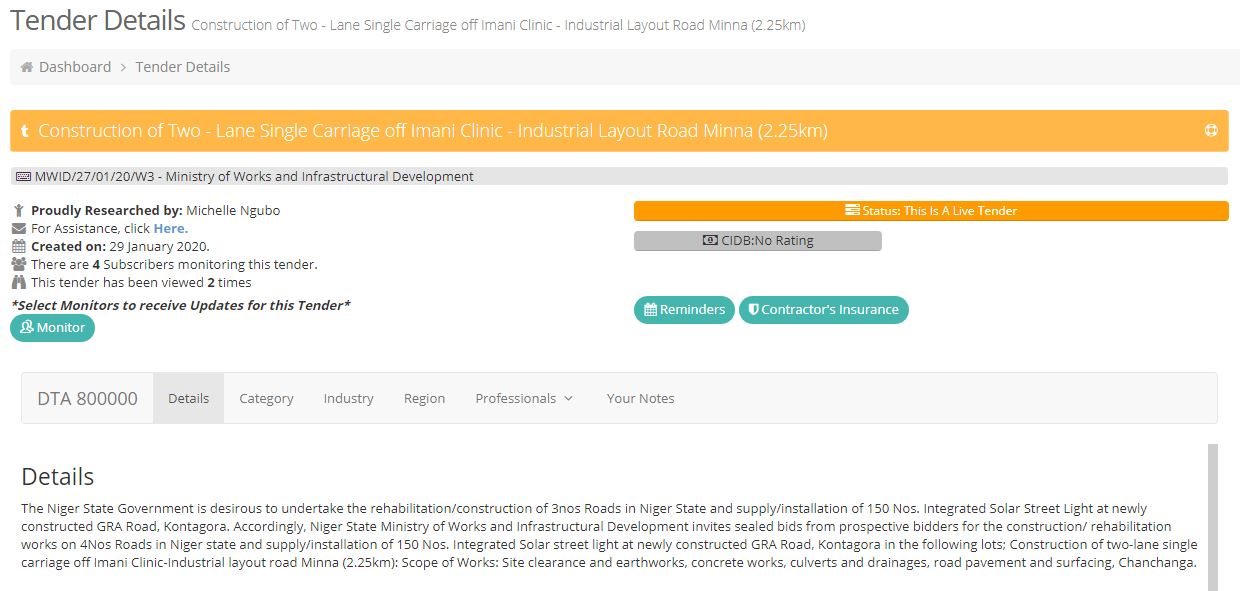

How do you find Tenders?

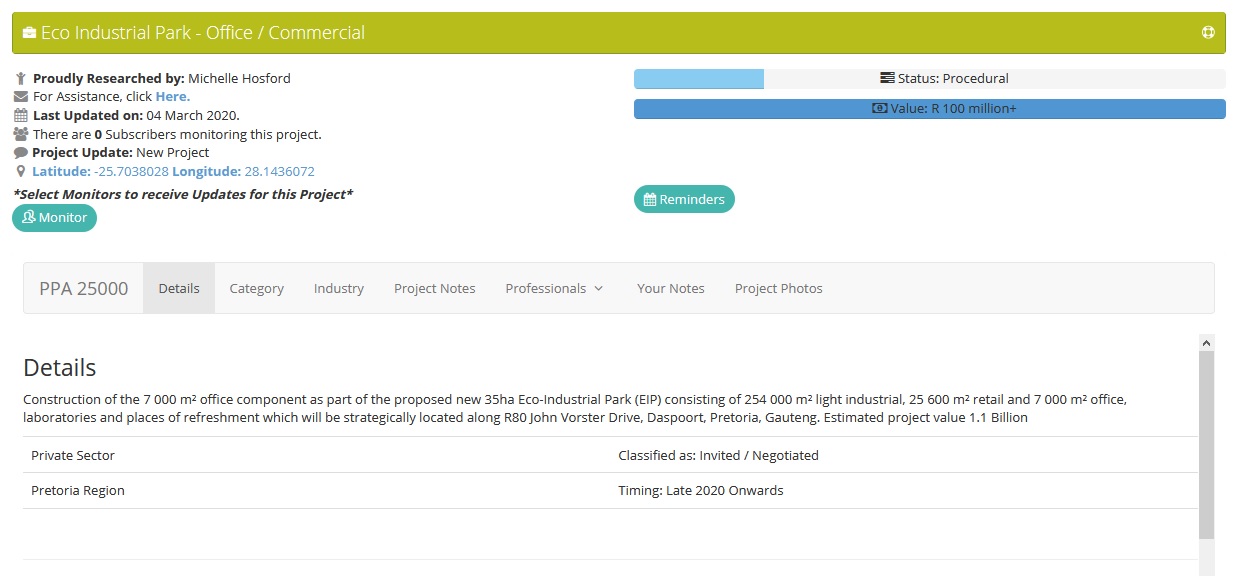

Most Municipalities and Departments publish tenders in the Government Bulletin, in most newspapers, and on Government websites. Another time saving and cost-effective option instead of searching high and low for tenders is to subscribe to Leads 2 Business, where we search for tenders for you.

We simplify this process by sending you a summary email at the end of each business day of the tenders that are relevant to your business. Thereby saving you the time and money usually spent sifting through papers, online resources and the general running around to find all the necessary information. For more information on subscribing click here.

How to decide on whether to Bid on a Tender?

Preparing construction tenders can help your business secure future work, but it comes with its own price tag. Tendering is time-consuming, consumes valuable resources and costs money.

In the event you don’t land the contract, the money and time spent are lost, so before you are knee-deep in paperwork, you need to weigh up the costs of whether or not a tender is worth bidding for.

|

Here’s a quick scan through:

- Get a copy of the tender documents and scrutinise them.

- Establish if you have the necessary technical, skill and experience requirements to satisfy the breadth of the work.

- Calculate how much will it cost to prepare your bid.

- Does the scope of work align with your business strategy and the future positioning of your business?

- How much profit can you make?

- What will the impact be on your current business, in terms of other jobs, staff teams and your capacity to take in other new business?

- Do you have sufficient cash flow?

- Is there a future networking opportunity or advantage to having this job in your portfolio?

|

|

How to approach the collection of Tender Documentation?

Pick up the phone and call the contact person, their details will be stated on the tender advertisement/ notice. Get clarity on how the tender document can be collected.

Important to know:

Site inspections are just another way companies / clients distribute information on a construction project. Bear in mind that some site meetings are compulsory and not attending the meeting will immediately disqualify you from tendering.

Armed with the collected tender document and the decision to tender. The next question is:

What should you put in your Tender?

Address the client’s needs and how your team of experts can solve their problems. It is much like a CV, communicating you have the necessary skills, experience, and team to fulfil their requirements.

Include ideas that will proactively address concerns on future maintenance and staffing implications or innovative ways of doing things that might save on resources. If there’s a pre-qualification document, make sure you go through everything in the document and address each aspect.

Value for money is what determines most bids, not just the cost. Can you offer something to the project that can’t be addressed by the client?

Highlight the benefits to their business, your service improvements on offer, the quality, your reliability, your projections on lifetime or future costs, how you can reduce risks and low maintenance, as well as previously satisfied customers.

Cautiously analyse all the costs and pricing factors of the contract. Do not neglect your fixed costs such as wages for staff who could be working on something else.

Contract Management

Showcase that you:

- have the resources to do the work in a cost-effective way to meet the client’s needs,

- can meet deadlines and respond flexibly to changing situations,

- can manage potential financial, commercial, and legal risks that could cause contract failure.

Provide the details of your team, highlight successes with similar projects as well as qualifications and experience to emphasise their strengths.

How to compile your Tender Submission:

Now that you know what to put in your tender document, you can begin to compile your submission.

Every tender has a closing date, which is a very firm deadline after which no tenders will be accepted. There is no exception for late tenders if the closing date has passed, and you have not submitted you will have missed your window of opportunity.

Since bids or tenders are binding legal documents in South Africa, they have to be completed in writing. Tender submissions will have a series of associated forms, which must accompany the tender. The specifics of the forms you will require for your tender will be listed in the tender documentation or be included with the tender or bid documents that you receive. Carefully complete these and get professional advice if you are unsure of anything.

As a general framework, here is a list of the forms that are usually required for national and provincial business tenders in South Africa:

- The Bid

This is the document that you agree to be bound by, in the terms and conditions of the tender.

- Current Tax Clearance Certificate

Your taxes must be up to date for you to be successful with your tender or bid. This document has an ‘Application for tax clearance certificate’ form attached to it. To obtain a tax clearance certificate you have to complete this form and hand it in at your nearest South African Revenue Services (SARS) office. The original tax clearance certificate that you receive from SARS, will need to be attached to the tender or bid documents. This certificate serves as confirmation that you are not in arrears with your tax payments. You can also submit a Tax Compliance Status PIN. The PIN can also be printed in the form of the TCS result letter from the SARS website. This can be submitted instead of a Tax Clearance Certificate, in some cases. This will be specified in the tender document.

- Price and motivation

Which of these documents you complete depends on the subject of the tender and is often amended for the particular tender, so carefully check which one you need to complete. In this form, you motivate your price, by describing the product you will supply or detail the experience of the person who will perform the service(s).

- Declaration of Interest

This is the document in which you declare whether or not you have a relationship (friend, family, business leads) with anyone who works for the government. This is so that those people are not involved in awarding the tender in any way, to avoid corruption.

- Preference certificate

You must fill in the form for tenders even if you are not claiming any of the preference points.

- Contract form

This is the contract that binds the parties should the tender be successful. There are different forms for different contracts.

Other documentation recommendations that may be required:

- Ensure your business paperwork is all up-to-date:

-

- Appropriate business license,

- Registered bank account,

- You are physically capable and financially able to complete all work tendered for – with necessary proof (Cvs/ completion certificates);

- Registered on relevant databases:

- The most important one at the moment is the Central Supplier Database (CSD), which is the Government Database that all Departments and Municipalities use to check that your documents are in order. (www.csd.gov.za)

- Some of the Departments or Municipalities still have their own databases, so be sure to check when you have to submit a tender that you are on their database, if necessary.

- For Quotations (in some cases, up to R1 000 000) you need to be registered on their own databases to be invited to quote on quotations, as these do not get advertised publicly.

|

|

Writing your Tender:

Ensure that you match the tender specifications and answer every question.

Much like a CV, create a summary to highlight why it addresses the client’s needs. It may very well be the last thing you write, having gone through the entire scope of the document, but include this overarching summary at the beginning of your tender.

Common Tendering errors and things to Look out for:

- Always read through the tender documents carefully.

- Complete the document in full.

- When you have invested so much time and money to get the documents, go to the meeting and complete the documents, the last thing you want to do is over price. Do a proper cost analysis when calculating your bid prices. Bids calculated too high or too low are considered unresponsive.

- Prices for labour, materials, and equipment all fluctuate. So charging 300% for something where everyone else would charge 150%, would likely lose your bid.

- Tender prices and calculations must be correct. Check and TRIPLE-CHECK this! A mistake here could cost your company dearly.

- The advantage is granted to 100% black-owned companies.

- There are also advantage granted to Previously Disadvantaged Individuals (PDI) or women-owned companies.

- If you are an HDI, remember to claim your points. Any points you don’t claim are points lost!

- Ensure that you complete your tender documents in full and attach all documents that are required. Always provide all of the information requested in the tender application. Do not forget things like your tax clearance certificate and shareholding certificates. Note: out-dated tax clearance certificates are also not permitted.

- Check your interpretation of the scope of the work. If you are unsure of anything in the tender, be sure to ask. Make enquires about the bid and obtain all the relevant information before completing the tender document.

- Sign your bid document. It sounds so common sense, but unsigned documents are unresponsive and will, therefore, be disqualified.

- Deliver the tender into the right box and before the closing time. Remember there are no exceptions. By law, no late bids will be accepted, not even 1 second past the closing time.

- If samples are requested, sufficient amounts must be supplied to enable the item to be evaluated under the appropriate technical or clinical conditions. Ensure that any requirements related to compliance with SABS specifications are met. Quality services and products will only serve to aid your record of good standing with the department.

Clients will expect you to:

- State the purpose and origin of the bid.

- Include a cover letter that responds to the bid invitation, summarises your main message.

- Have an index that explains how the documents are organised.

- Explain the benefits and value for money of your bid.

- Have a summary of your work as a contractor, past experience and credentials for this job.

- Demonstrate your team’s skills, the experience of similar work and their responsibilities if you win the contract.

- Explanation of how you plan to carry out the work.

- Be practical and identify potential problems without promising what’s clearly impossible for you to deliver.

- Provide details of your pricing and any aftercare arrangements within the price.

- Manage the details of the projects and their scope.

- Create a timeline as to how and when the client’s aims will be achieved.

- Detail when and how goods and services are to be delivered, with a supporting timetable.

|

|

Delivering your Tender:

Congratulations, you have made it this far! It is not a small administrative task, but once you have all the forms completed and signed, place your tender in an envelope with the tender number on it (double-check this) and deliver it before the closing time, to the place specified on the tender advertisement.

Respondents are allowed to be present at the delivery point when tenders are opened. In South Africa, most tenders are opened in public, whereby the name of the company is announced with the tender prices and associated costs.

Follow-up on your Tender submission:

After you have submitted your tender, it is a good idea to place a follow-up phone call to the client and query the status of their adjudication process. Your approach should be friendly, helpful and encourage them to please contact you should they need any further clarity. This will only serve to affirm your commitment and eagerness to win this tender.

There is the possibility you may be requested to do a presentation to the client.

It is an incredible opportunity to prove to your client that you have the skills and capacity to deliver the project per your tender response. The client will ask for questions for clarification. Prepare well, know your tender document thoroughly, speak confidently at the presentation and answer questions to the best of your ability.

What happens when the Tender Contract is Awarded?

After the adjudication process (which can take some time), the client will award the project to either:

- a single company,

- a consortium of enterprises or joint venture

- or it may choose to not award the tender.

| If you are awarded the tender, you will receive a letter of appointment. It is important that you respond to the client and confirming your appointment and setting up an initial kick-off meeting.

Take charge, be proactive and show your client that you know what you are doing. Follow this through by delivering a quality project on time and within budget. |

. . |

What if you are Not Awarded?

Bear in mind that when you have submitted a tender and the evaluation stages have passed, all tenderers should be notified, by law, of the intended / suggested successful company. There should also be an appeals / objection period given to those who were unsuccessful. This is where you may object to the intended / suggested company, for whatever reason (e.g. your price was lower than theirs). Take note of how you are instructed to submit your appeal / objection and take special note of the deadline for appeals / objections. Late appeals / objections are not considered.

In the event you are not awarded the project, it is possible to query the reasons as to why you were unsuccessful. This information is helpful for future tenders so that you can learn from any mistakes. However, be realistic and be mindful that you will not win every tender that you respond to.

With all these tips, I sincerely hope that the tendering process will be easier for you and that you may be better prepared for any future endeavours.

Wishing you all the very best!

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Articles, please visit our Leads 2 Business Blog.

.

.