1. Don’t be afraid to delegate

You are losing money and precious time each day the files pile on top of your desk. Be sure to clearly define goals and objectives to your employees. Educate your employees on your expectations. Give responsibilities to qualified employees, and trust that they will perform the tasks well. This gives your employees the opportunity to gain skills and leadership experience that will ultimately benefit your company.

2. Match tasks to skills

Knowing your employees’ skills and behavioural styles is essential for maximizing efficiency. Asking your employees to be great at everything just isn’t efficient, instead, before giving an employee an assignment, ask yourself, is this the person best suited to perform this task? If not, find someone else whose skills and styles matches your needs.

3.Communicate effectively

Every manager knows that communication is the key to a productive workforce. An age-old aphorism goes, “It’s not what you say, but how you say it.” Good communication is what separates a poor leader from an exceptional one. When you communicate well with your team it helps eliminate misunderstandings and can encourage a healthy and peaceful work environment. Some examples of communicating effectively would be communication via training; having open meetings; listen to your team members; use visuals like presentations; display confidence and seriousness; act out your message; be humorous; encourage feedback and be appreciative.

4.Keep goals clear and focused

Everyone and every business needs goals. Make sure yours are S-M-A-R-T ones…

S – Specific

M – Measurable

A – Achievable

R – Relevant

T – Time-based

Monitor and measure your progress by conducting quarterly reviews. This will help to keep your team on target and working together. Be flexible and open to adapting to the situation as some goals will no longer be relevant or achievable. Try to keep them realistic and reasonable.

5. Incentivize employees

Most people agree that receiving money is a good incentive to work harder and stay motivated. There are however people who prefer to be recognized in a different way. It costs nothing but goes a long way with employees to hear how well they are doing. Practice boosting morale with words of encouragement and by catching people doing things right. Another way that won’t cost the earth is a brag board. Mention the employee’s good work in a place where everyone can see it. Printing certificates of achievements that the employee can put on their desk, in their office or cubicle. Throwing a staff lunch

6. Cut out unhealthy stress

Studies show that excess stress can cause real physical symptoms like headaches, upset stomach, increased blood pressure, chest pain and trouble sleeping. Not to mention mood disorders like anxiety and depression. Of course, not all stress is created equal. A certain amount of healthy stress in the workplace is actually a good thing. Here are a few points on how to relieve unhealthy stress at work: Form positive relationships; start exercising; eat healthy nutritious foods; get enough sleep; prioritize and organize, and kick bad habits.

7. Train and develop employees

Employees are a company’s biggest asset and investing in talent is vital to sustainable business growth and success. Boredom in the workplace can create feelings of dissatisfaction and negative working habits. Regular development initiatives can prevent workplace idleness. Having frequent training will also establish regular re-evaluation of employees, skills and processes.

8. Give each other feedback

Employees and managers the world over dread the ritual of performance reviews. We save up our comments and document all the things we note about a person’s performance and then, like a big cat ready to pounce, the manager calls in the hapless employee to spring a year’s worth of “constructive criticism” onto him or her. When done the right way with the right intentions, feedback can lead to outstanding performance. Employees have to know what they are doing well and not so well, carefully and frequently. When done the right way with the right intentions, feedback can lead to outstanding performance.

9. Think Big picture

Looking at the BIG picture involves trying to see the entire scope of a task. This can be a tactical way to obtain a full sense or understanding of things. Sometimes the big picture can seem overwhelming so by breaking it down you avoid worry, procrastination or even disengaging completely from the task. Ways to help would be to block your time by using a calendar or create an itinerary. Consider a realistic and thorough overview of the situation. Think positively about the path you’ll have to take to get there and be confident. Figure out skills you can use or need to develop. The sooner you begin to identify what skills you need the sooner you’ll gain forward momentum.

10. Ethics & Honesty

An article in Forbes states: “Companies find that ethical business practices increase their competitiveness in their respective industries, helping to further substantiate the notion that a culture of ethics is crucial to sustainable excellence.” Sometimes the moral fibre of society and the blind ambition of some leaders will not even consider the two most important traits essential to making a decision: honesty and ethics. Honesty builds trust, one of the most critical elements of solid leadership. It is displayed and built on personal behaviour, the quality of decisions and open and honest communication.

Sources:

Forbes

CourseHero

Smallbiztrends

TheHartford

Kazoohr

Snacknation

Getsmarter

MindTools

Creativitypost

Bizjournals

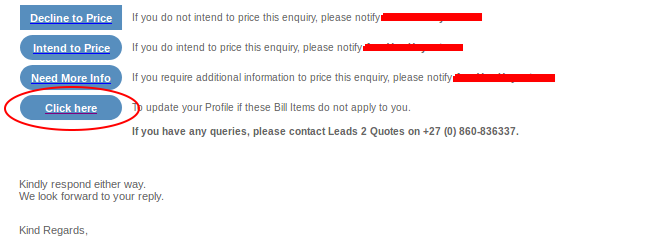

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Events, please visit our Leads 2 Business Blog.

About Helga Venter

My name is Helga Venter. I started with the company in 2004 and was promoted to Financial Director in 2007.