A Walk Through Your Advisory Setting

Welcome to the 1st edition of a new supplement we are adding to our weekly Blog called “Did You Know”.

We will use this insert to either teach you something new or refresh your memory on something old, but still interesting to know ;).

Today I’m going to give you the ins and outs and lowdowns of your Daily Advisories….. and right now I’m hoping you are not squinting your eyes and asking “What is a Daily Advisory?” lol! but just in case you are….. Lets start from the beginning 😉

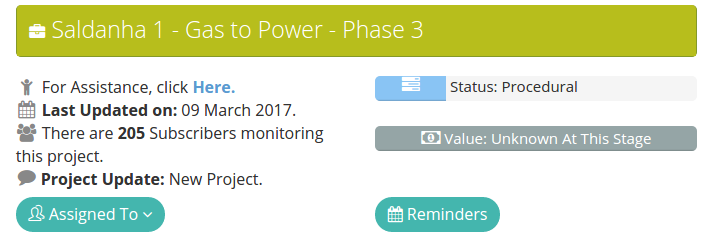

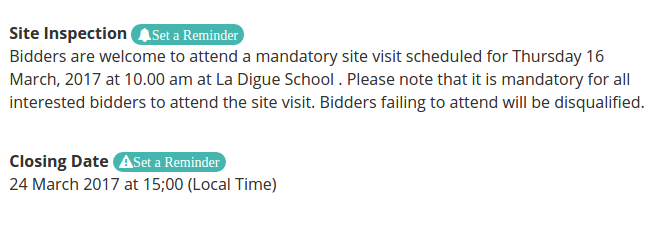

Simply put, your Daily advisory is all the leads we send you on a daily bases, according to the filters YOU selected.

So, Did You Know – you can adjust your Daily Advisory whenever you like? well, you can and this is how!

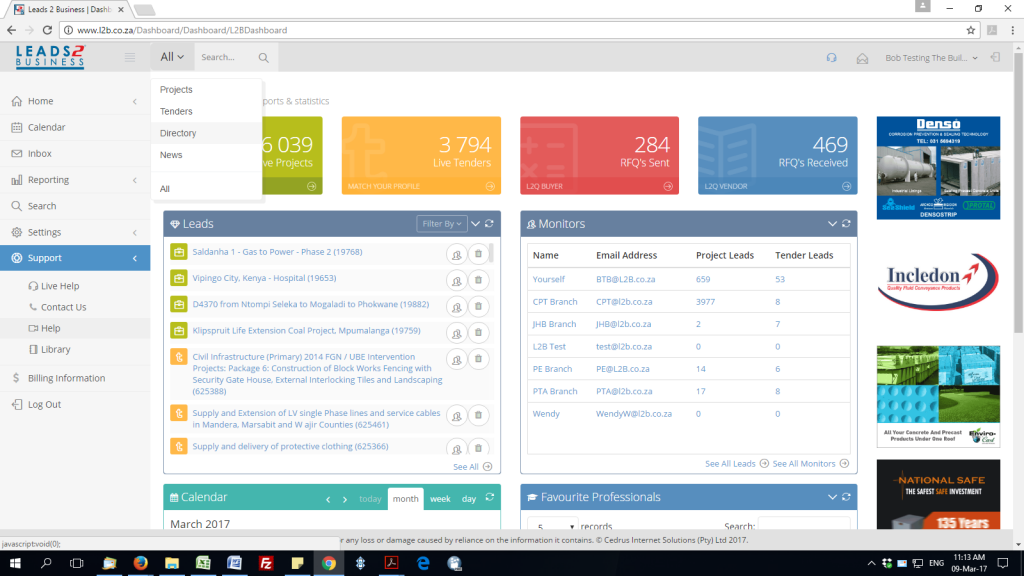

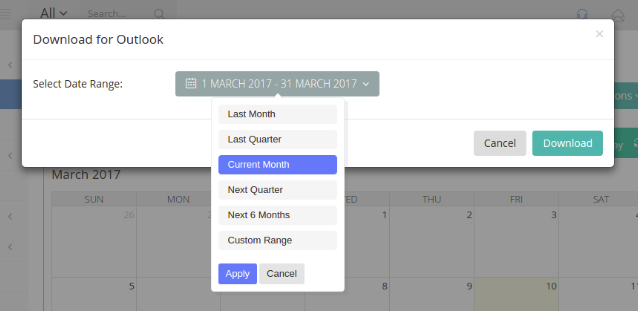

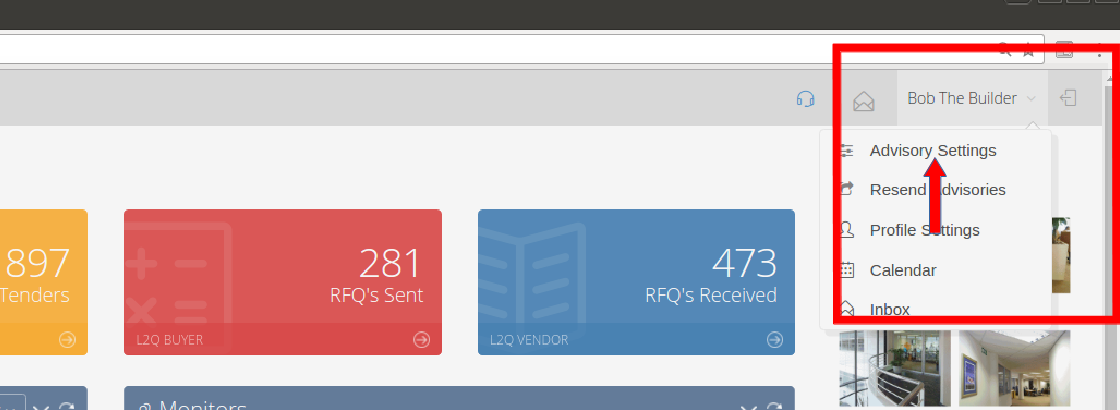

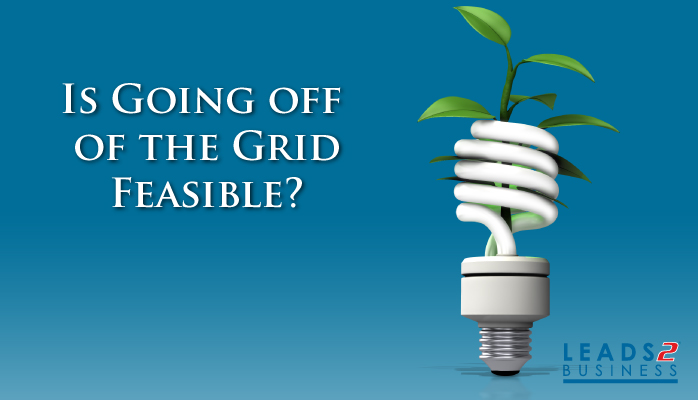

Once logged in – Hover your cursor over your Name, this will bring up a drop down menu as illustrated in the below diagram.

Select Advisory Setting and let us begin:)

There are 7 Consecutive Steps you need to follow.

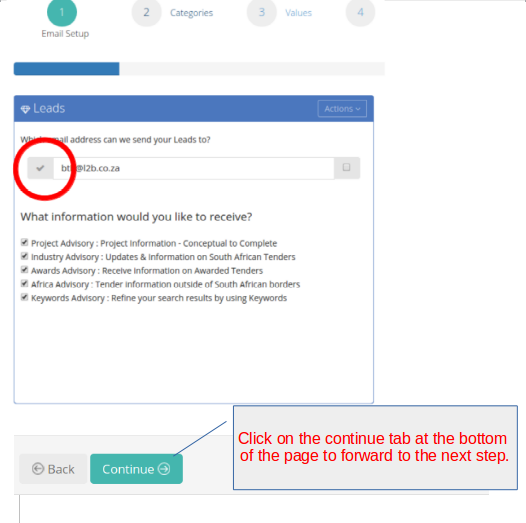

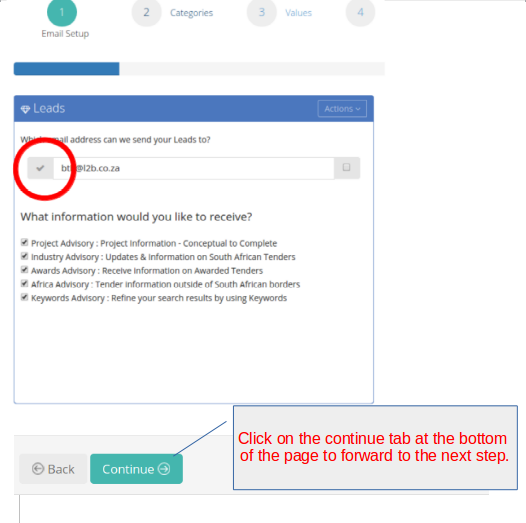

Step 1 – Email Set Up:

This is the email you have indicated to us as the one you want to receive all Advisories on. The Tick indicates that this email address has been verified, If you did not receive a verification email or if it got lost – you may click on the Action tab and resend the verification email to yourself.

Below that is a list of the advisories you are paying for – you may De-select any of these if you like (This will not alter your current monthly rate)

So why would you want to deselect an advisory? well for instance, if you are subscribed to Private Projects, we give you Daily Tenders for free, however you may decide you are not interested in receiving Government Tenders…. then you would just simply remove the tick next to Industry Advisory 🙂

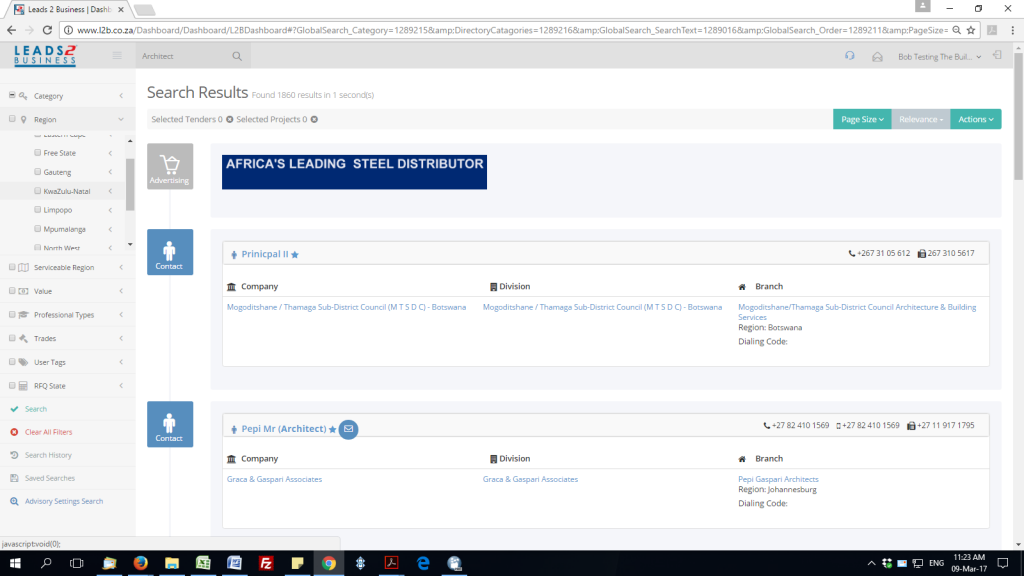

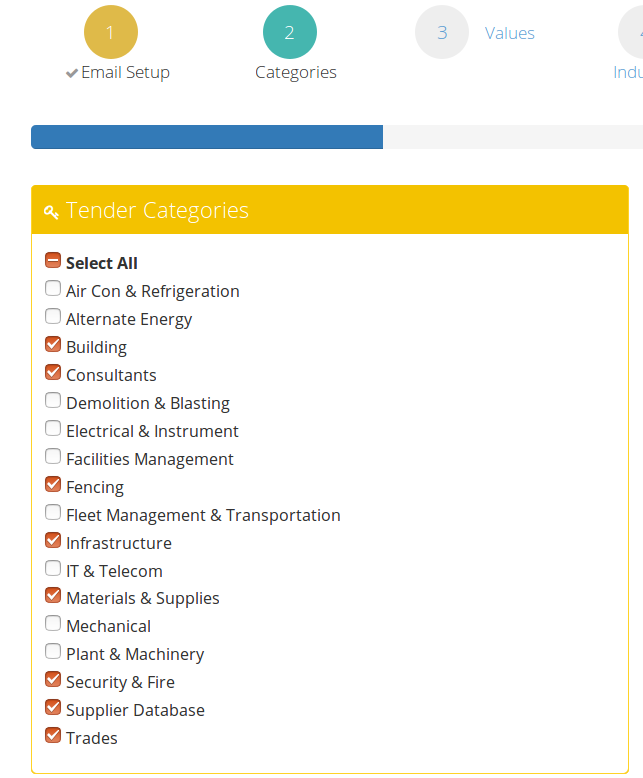

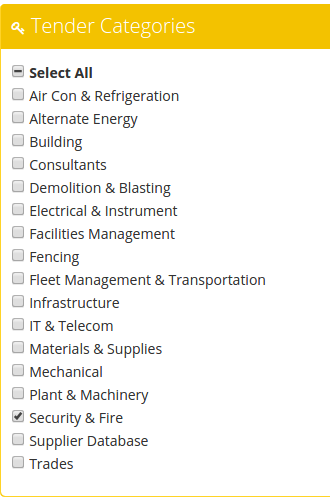

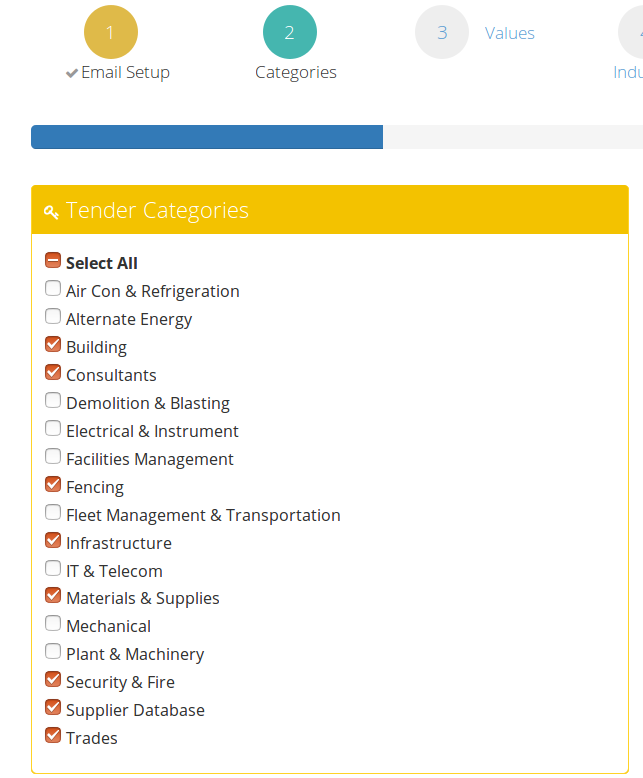

Step 2 – Categories:

This is where you decide exactly what leads you are wanting to receive.

First lets go though the Tender Categories – you may select as many or as few of these as you like.

*Please be advised that if you opted out of receiving an Industry Advisory in the previous step, you should not have anything selected here.

Project Categories: Often large developments have both a building and infrastructure element and because both of these elements may not interest you, we have given you the power to choose whether you would like to receive updates on both or just one.

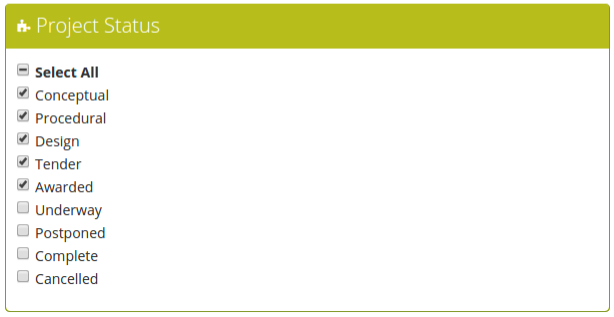

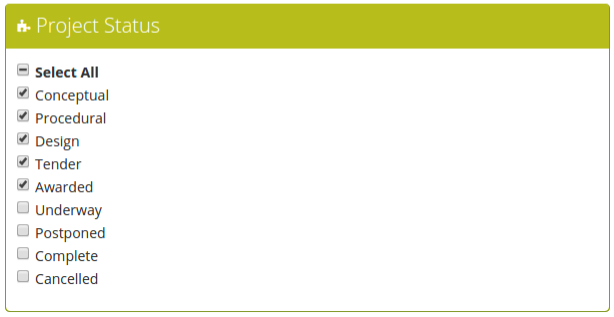

Project Status: These are the various stages in which a Project moves through from Conceptual right up until Completion.

Once again, we don’t see why you should receive information that is irrelevant to what you do, so here you get to decide what stages of the Project you would like to receive.

* Please be advised that the last two options will not be available to you, unless you are a Private Projects Subscriber.

OK so lets move on.

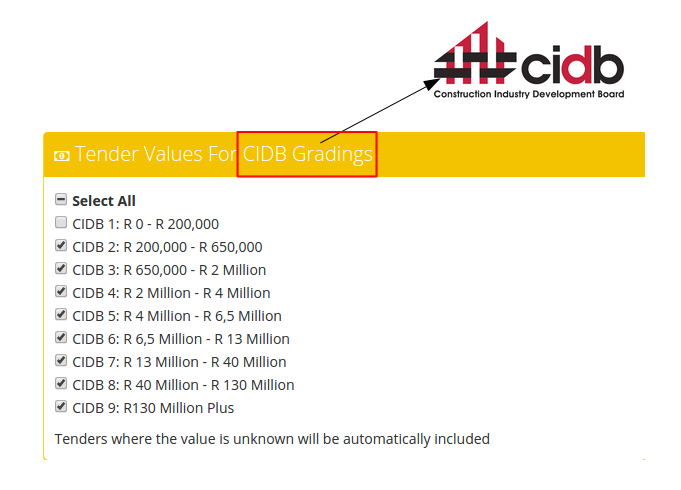

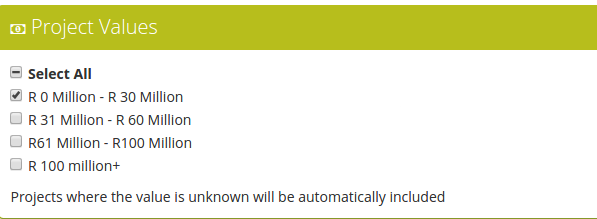

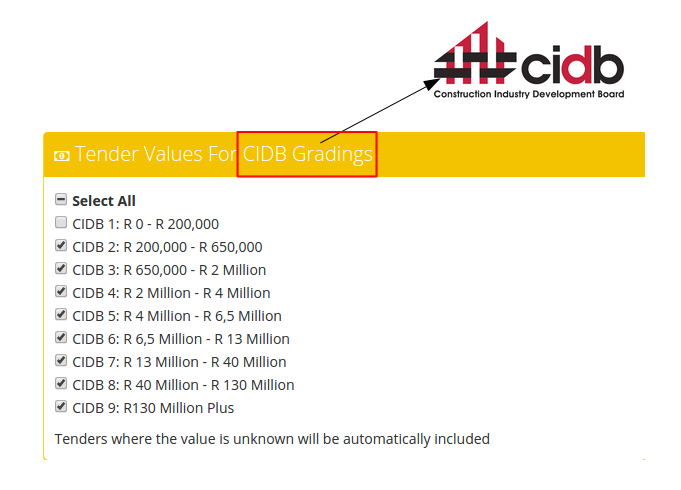

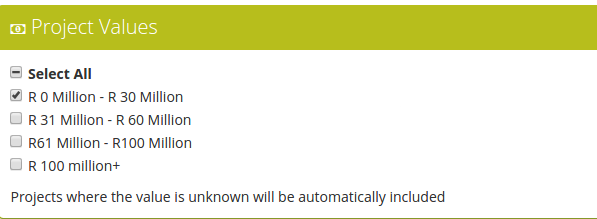

Step 3 – Values:

If you have a CIDB Grading you can be quite specific here, however if you are, for example, a Consultant and don’t require a CIDB, you should still select all, as there will be instances where a tender is Turnkey and there may be a CIDB requirement for the contractor all on the same tender.

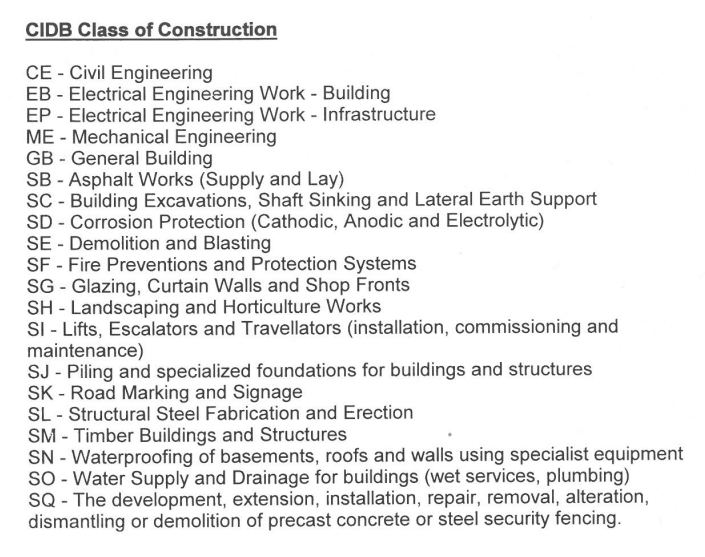

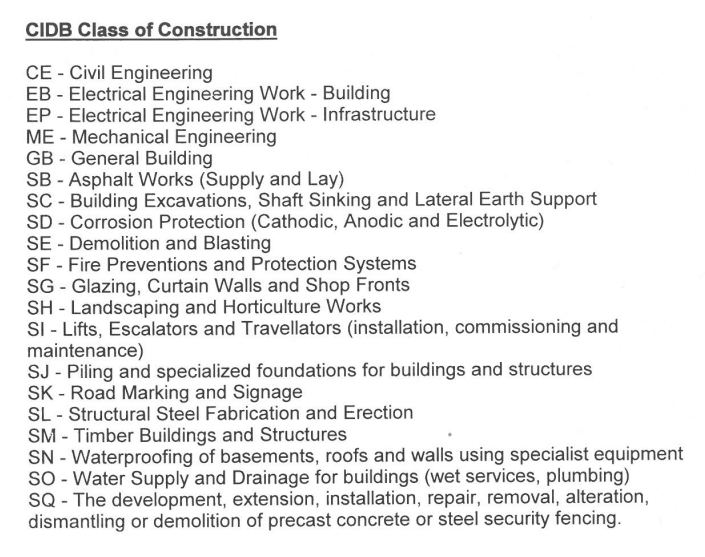

Just for interest sake I have listed below the industries that may apply for a CIDB grading 🙂

The Project Values refer to the size of the Development, here you may decide which size Projects would be of interest to you .

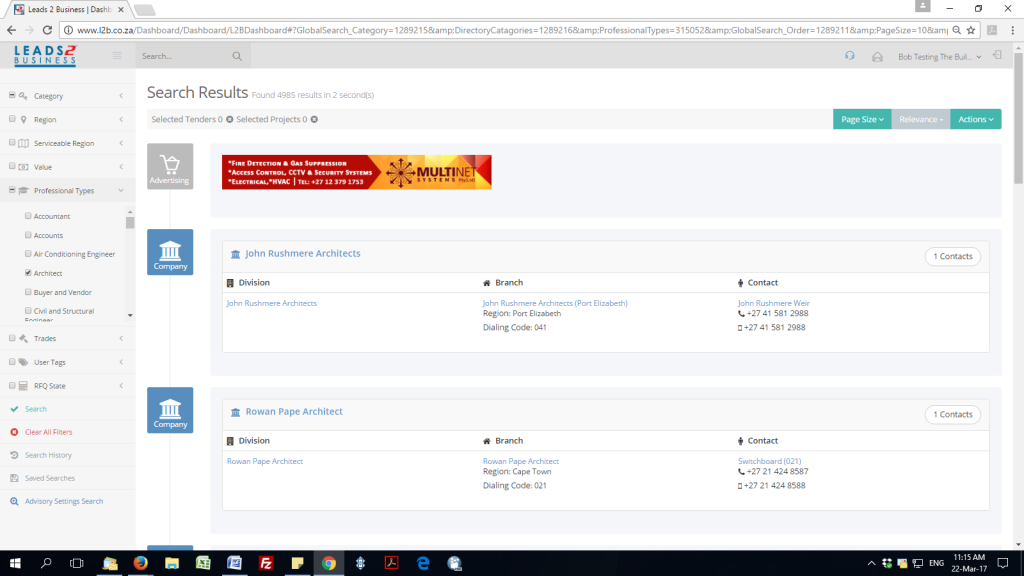

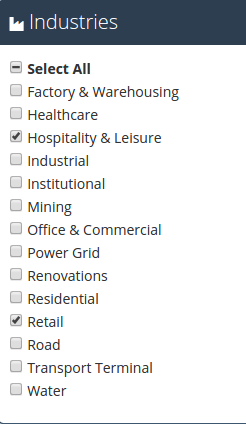

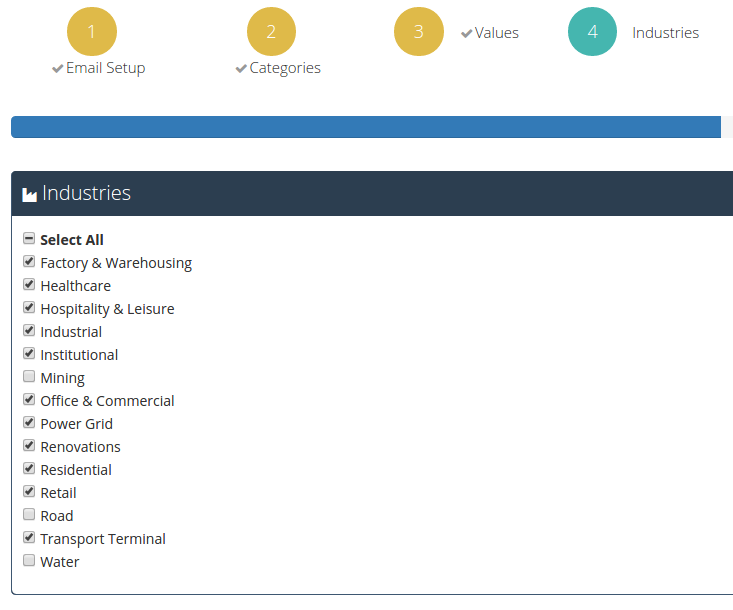

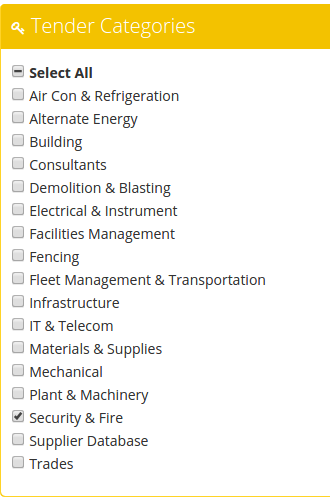

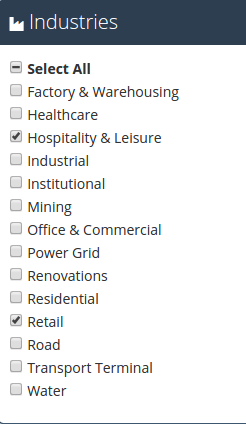

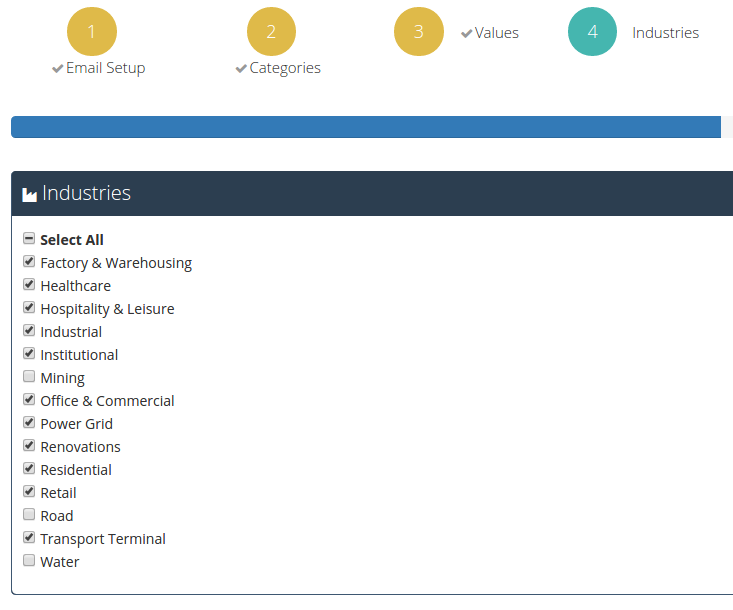

Step 4 – Industries

Now this is two fold, firstly if you have Tender Categories selected, here you get to be specific about the industries you service.

For instance: If your company was in the security sector and really only supplied and installed security solutions to the Hospitality & Leisure as well as the retail sector, then this is what your advisory would look like:

* Please note that without an industry selected, your selected Category will be deemed null and void.

OK so that covers the use of industries for your Government Tenders, now to explain them in Projects.

Now remember, you would have already selected whether you are interested in the Building or Infrastructure Projects in Step 2 – Categories

So now lets say you selected only Building, you can now use the industries selections to tell us in what industry you would like to receive Building Projects ….. are you still with me?

You would not select anything pertaining to Infrastructure, for example Roads or Water.

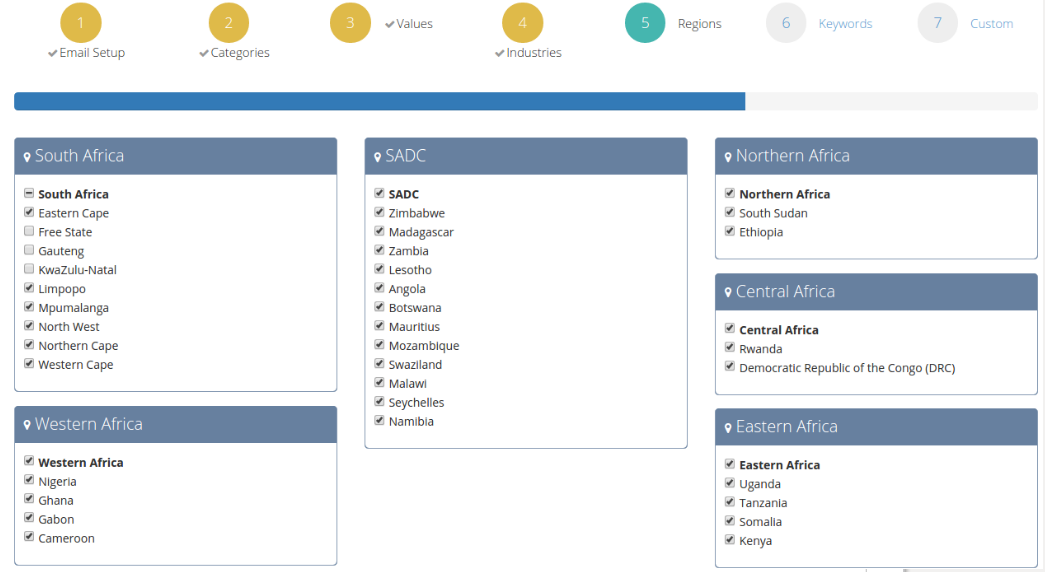

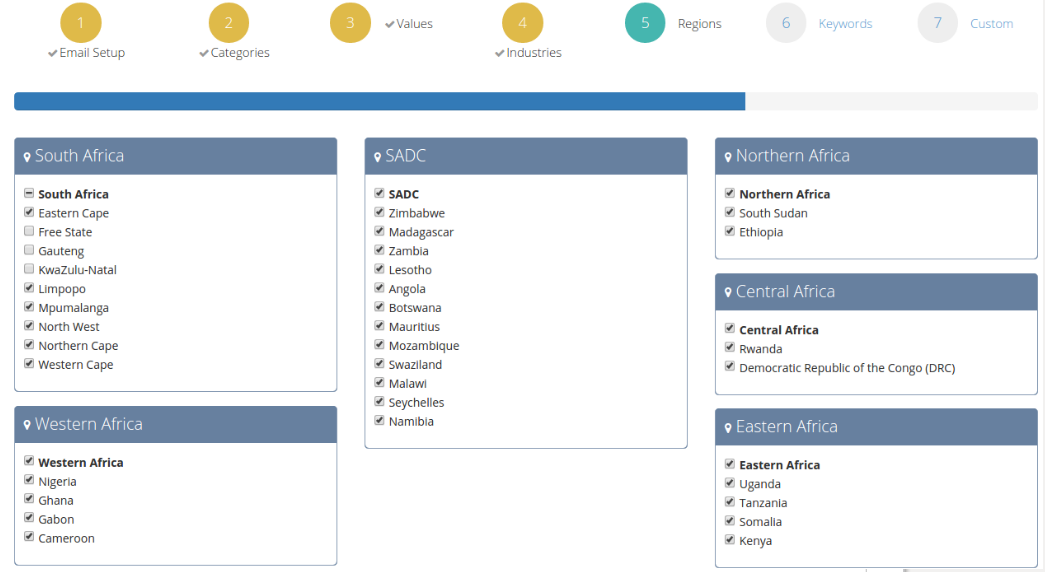

Step 5 – Regions:

Regions are subscription dependent, meaning the following:

Daily Tender SA – You may Select as many regions under the South Africa selection.

Daily Tender Africa – You may select any of the Non South African Regions.

Daily Tender SA +Africa – You may select from all the regions available.

Private Projects – You may select from all the regions.

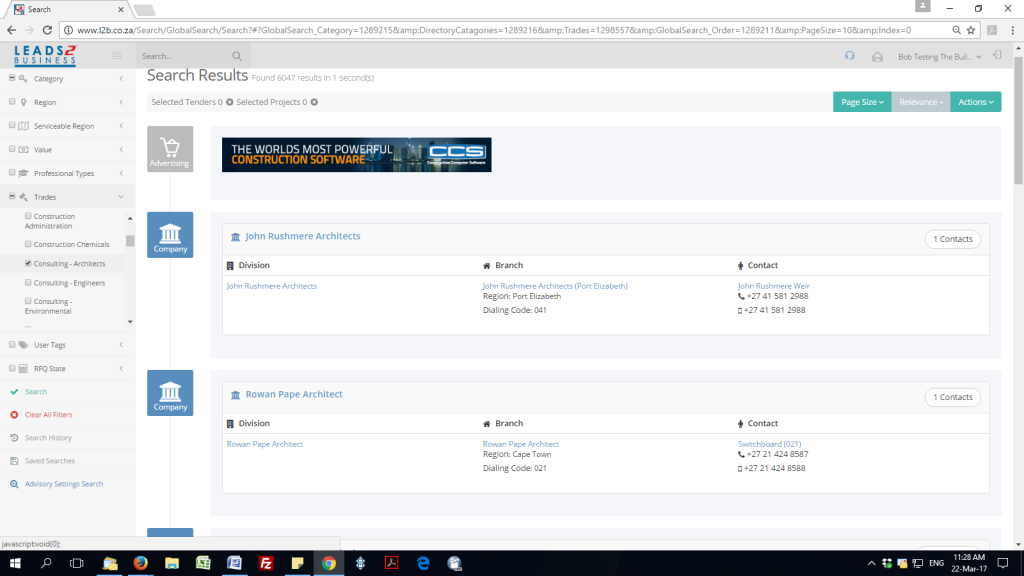

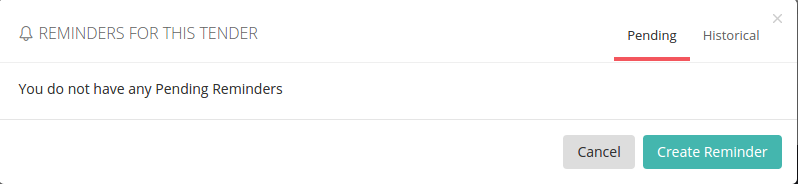

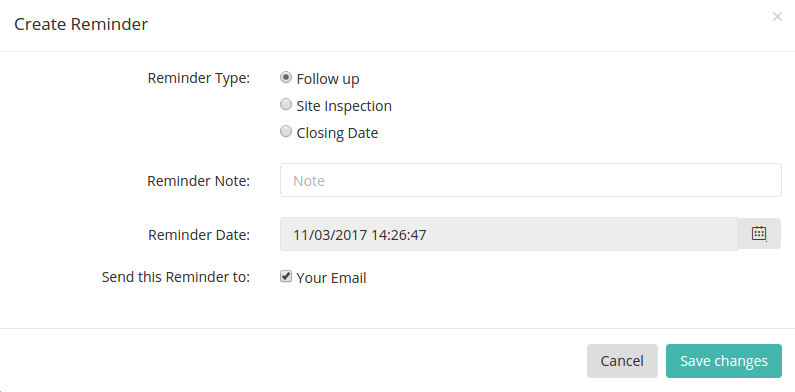

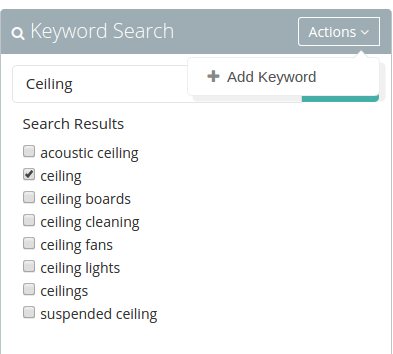

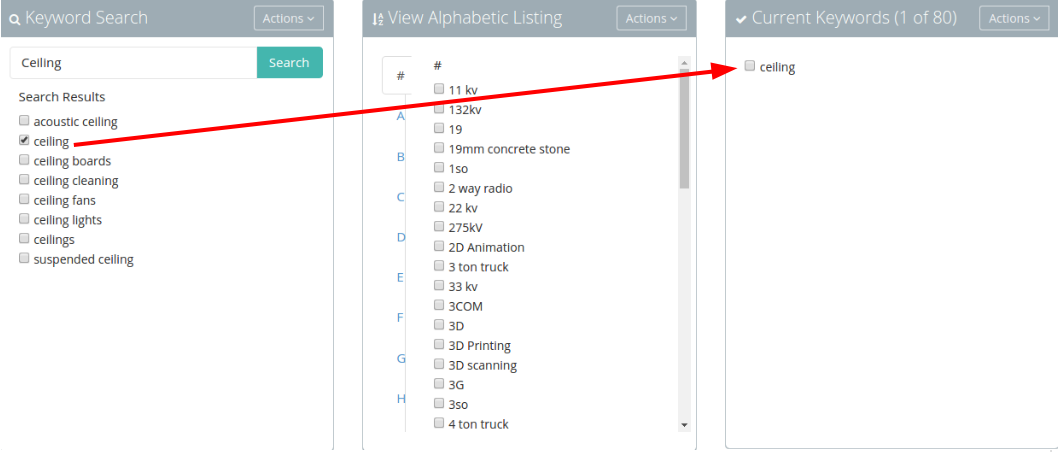

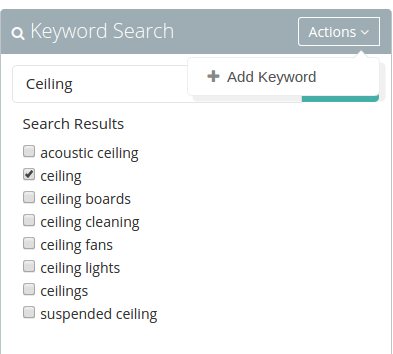

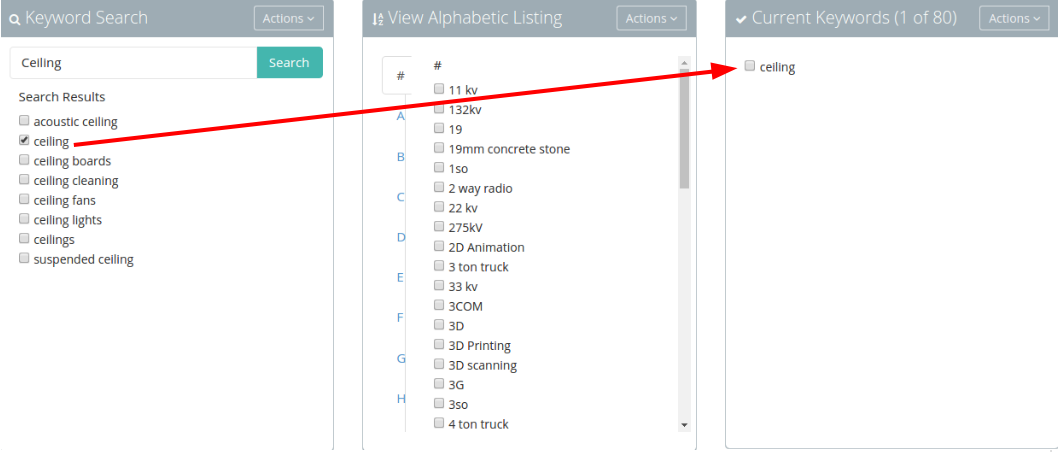

Step 6 – Keywords

This is your fail safe step, this ensures you miss nothing!

First search for your keyword, then Select the keyword and by using the action tab, click on the add Keyword drop down.

And just like that you have added your first keyword.

You can select multiple words and add them to save time:) – You may select up to 80 Keywords.

And here we are at our final step…

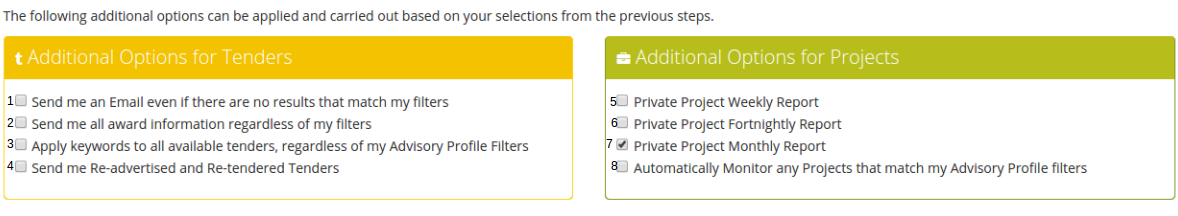

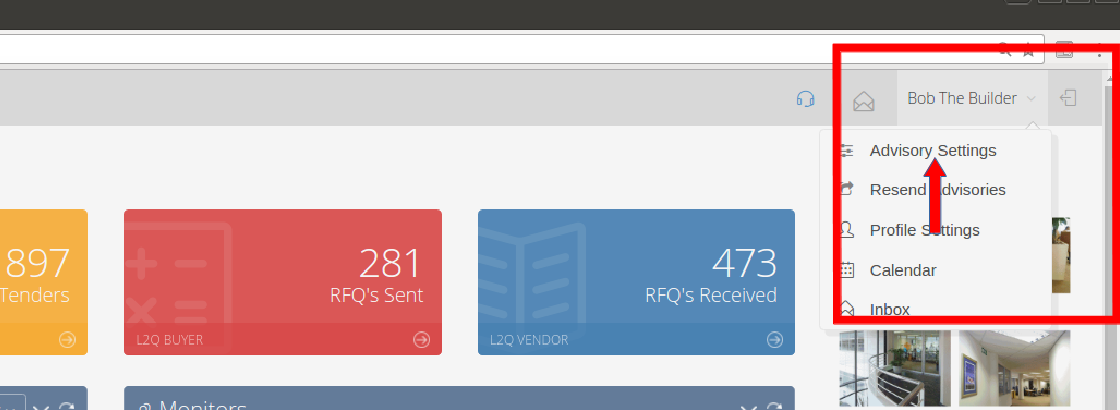

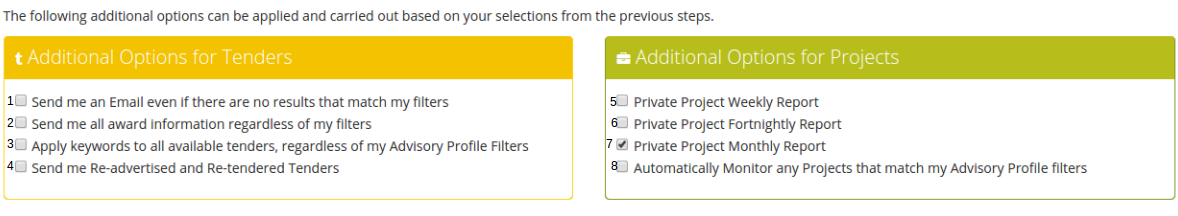

Step 7 – Custom

These options are self explanatory, however I do want to clarify the following:

- By ticking this option, we will still send you an advisory even if there is a day whereby your filters don’t match anything we have updated or published for that day. If this option is ticked and you DON’T receive an advisory on a particular day – give us a call so we may see what the issue was.

5,6,7. You may select one of these in order to receive a breakdown of all your monitored Projects

8. Automatic Monitoring saves you from having to go through Projects and having to monitor them yourself. By selecting this option, the system will automatically monitor all Projects published that match your filters.

Once you have gone through step 1 to 7 and are happy with your selections please make sure you click on the SAVE tab at the bottom of the page 🙂

And that is our walk through your Advisory Setting :).

Of course if you are still unable to do this yourself, you are always welcome to contact your Account Executive or call Head Office for assistance:).

I hope you found this helpful, if so, please look out for our next edition of DYK 🙂

If you are interested in becoming one of our subscribers, please visit our website.

To view notes with screenshots on how to use our website, please visit our Wiki site.

To view more articles, please visit our blog.

I am a strong believer in "What you put in , is what you will get out" and this drives me every day, whether it's at home with my gorgeous family or at work where I get to fuel my competitive spirit.

I love who I am and who I'm becoming.

I love where I am , but more importantly where I'm going....

#EternalOptimist #Aspire2Inspire