About Candice Erasmus

I have been working at Leads 2 Business for 10 years of which 8 have been as the Sales Manager. I enjoy every aspect of my job and strive to hold the L2B flag high in all I do.

I have been working at Leads 2 Business for 10 years of which 8 have been as the Sales Manager. I enjoy every aspect of my job and strive to hold the L2B flag high in all I do.

Click here for a business insurance quote and ask to meet with your own dedicated Business OUTsurance Broker.

OUTsuranceIf you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Featured Companies, please visit our Leads 2 Business Blog.

I started working at Leads 2 Business in February 2014. I'm a Senior L2Q Account Executive for the Cape Town Region.

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Featured Companies, please visit our Leads 2 Business Blog.

I joined Leads 2 Business as an Account Executive in July 2011 and was part of the dynamic sales team in JHB for 2 years. I relocated to the beautiful city of Durban in 2013 and absolutely love KZN. I am very proud to be part of the L2B family and Legacy!

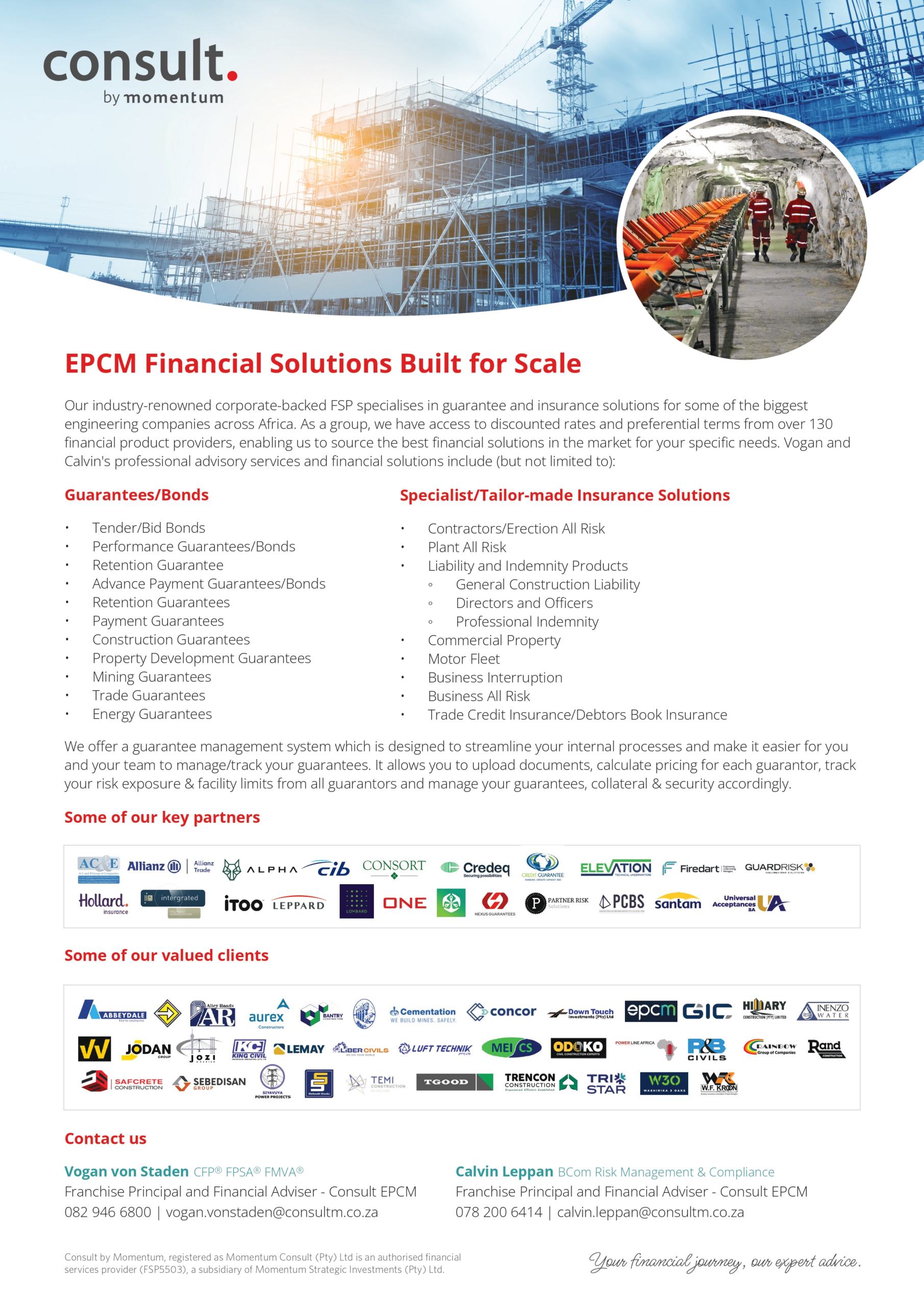

A quick 1m 33s video tutorial from “The How-To Series”

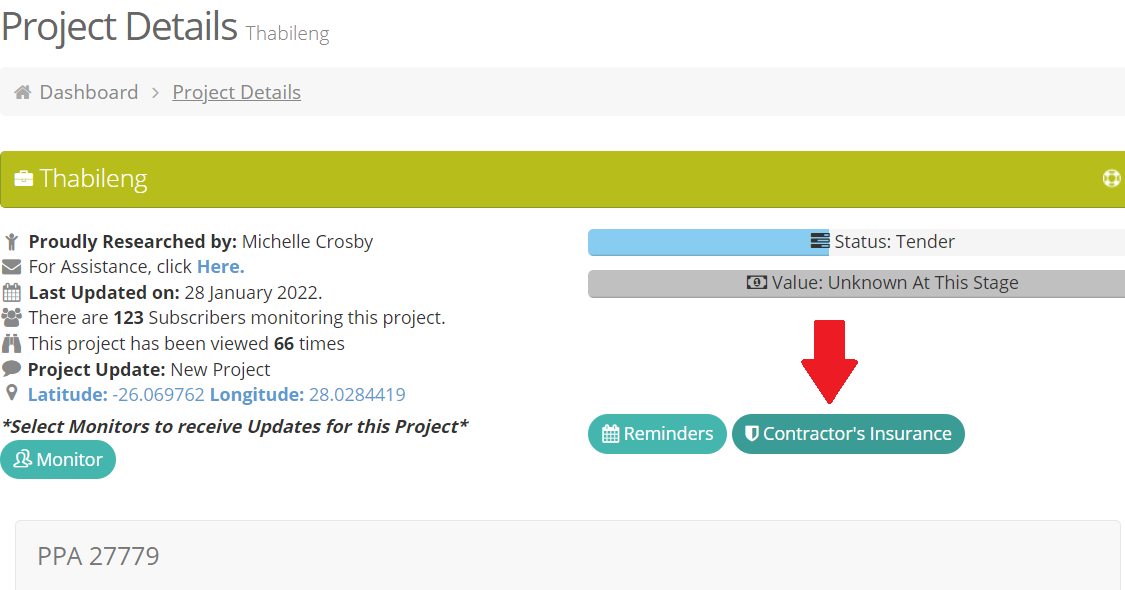

Request Insurance quotes on a specific Tender or Project by clicking on the CAR Insurance button and view more details on available CAR Insurers.

Do you have a ‘How To’ you’d like us to cover? Leave a comment and let us know.

Check out more content here

To view more from our How-To Series, please visit Leads 2 Business Blog.

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view our Wiki Help with screenshots and video tutorials, please visit Leads 2 Business Wiki.

Millennial Mom + wife living the hash-tag life. Reach out if you want to talk: L2B, social media, construction, technology, marriage, parenting, popular culture and travel. Remember: If You Fail - Fail Forward

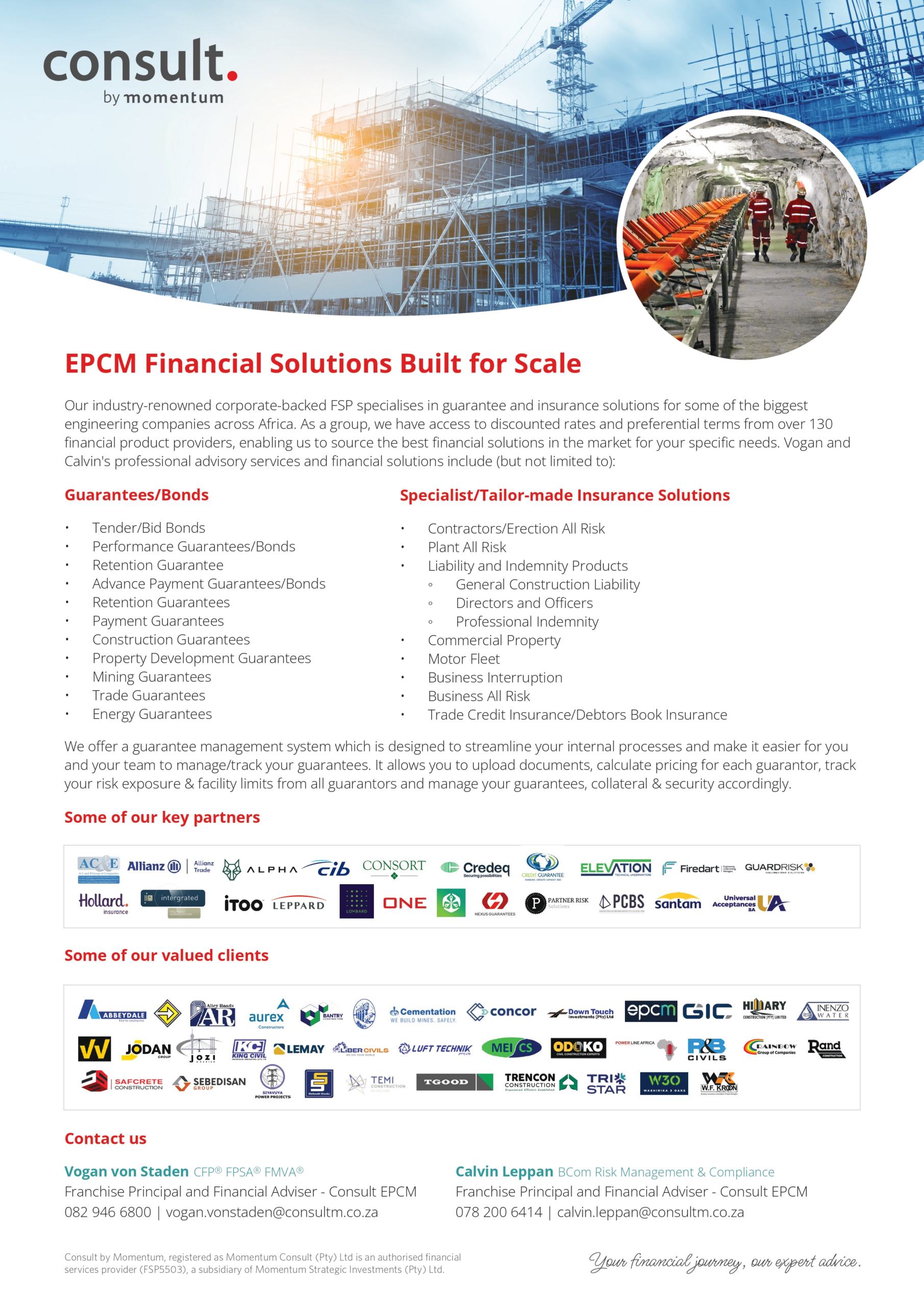

Our specialised services and offerings are aligned with the highest of standards and we pride ourselves in our exceptional service deliveries. With the support of our expert and qualified staff, combined with our expanding infrastructure.

Legendary Risk Solutions (Pty) Ltd specialised product offering, offers you:

Contract Works

This policy provides protection for Principals, Contractors and Sub-Contractors, covering construction projects, against physical loss or damage to the works during the construction phase. The projects can range from the construction of domestic dwellings, office blocks, water and sewer reticulation, roads, bridges or any other infrastructure development or process plants.

The policy can also provide protection for the Employers’/Contractors’ Legal Liability, in the event of injury or damage to third party persons or property, arising from the execution of the works.

Plant All Risks

This policy is designed to cover construction, mining and other mobile and non-mobile plant/machinery, against loss or damage whilst situated on-site or in transit to, or from the site. The cover can also apply to plant hired in or out by the employer and can cater for hiring costs following indemnifiable damage to the plant insured.

Machinery Breakdown

The Machinery Breakdown policy caters for sudden unforeseen physical damage to plant and machinery at the insured’s premises/factory. The cover includes damage resulting from dismantling and re-erection of machinery within the Insured’s premises.

The machinery can range from small refrigeration compressors and electrical motors to all types of machines used in mining, manufacturing and materials handling.

Loss of Profit

The policy caters for loss of Gross Profits or Increased Cost of Working (I.C.O.W.), resulting from a reduction in turnover following sudden unforeseen physical damage to plant and machinery covered under a Machinery Breakdown policy.

Deterioration of Stock

The policy is designed to cater for deterioration/spoilage of perishable goods held in cold storage facilities resulting from fluctuations in temperature caused by sudden unforeseen physical damage to machinery, such as the refrigeration plant, where cover is provided by a Machinery Breakdown policy.

Dismantling Transit and Erection (D.T.E.)

The Dismantling Transit and Erection policy provides cover for the movement of machinery between premises and includes the installation, as well as testing and commissioning of new machinery.

The cover can be extended to include Third Party Liability arising from the insured’s operations.

Works Damage

This policy is designed for the protection of manufacturers against damage to their products during the manufacturing process and or the property in the course of manufacturing arising from the impact caused by collision, dropping, swinging, overturning or collision at the manufacturer’s premises.

Computer and Electronics

The above policy provides cover for electronics equipment in its widest spectrum of use. The cover is on an “All Risks” basis, covering fire, theft, surge damage, malicious damage and electrical, mechanical derangement.

The equipment that can be covered by this policy ranges from P.C.’s (desktop computers) to medical apparatus, PABX’s (telephone exchanges), mainframes and laptops.

The policy can be extended to include Increased Cost of Working (I.C.O.W.) and Reinstatement of Data (R.O.D.).

We are linked to all Projects & Tenders on Leads 2 Business. Simply click on the Contactors Insurance button and request a quote from us.

Alternatively, visit our website or contact us on 082 456 6541

To view more Articles, please visit our Leads 2 Business Blog.

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

I started my journey with Leads 2 Business in 2013 as an Account Co-Ordinator. I transitioned into an External Sales position as an Account Executive in 2015. I help professionals within the building & construction industry keep up to date with the latest project and tender information as well as source new business opportunities throughout Africa.

Would you buy a new car without taking out insurance?

Would you buy a house and not insure your asset or the contents of your home?

With that in mind, when you own your own business, you would need comprehensive insurance. You need to make sure that every aspect of your company is covered to prevent major financial loss should an incident occur.

Here are some policy sections to consider:

Making sure every aspect is covered, will ensure that you are at ease and under less stress when you are working on a project. Ask your broker to do a comprehensive inspection at your premises that way leaving no stone unturned.

This will give you peace of mind allowing you to focus on your projects and deadlines and not on all that can possibly go wrong.

The majority of tenders require proof of liability upfront. This usually equates to 30 -70% of the contract value. In some cases, it is 2 – 3 times the value of the contract.

If you do not have a comprehensive commercial insurance policy, do you have at least R20 million gathering dust? In today’s economic climate, you can’t afford the risk.

It is usually easier, safer and much more sensible to have liability cover in place. Give it some thought, as this all might save your company huge amounts of time, money and stress in the future.

May you invest in your own company, to better your future and the lives of those you employ.

Not sure where to go from here? Click this option on your tender to obtain a no-obligation quote today.

Image Source: Pexels

To view more Articles, please visit our Leads 2 Business Blog.

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.