This won’t be a long read but I promise it will be worth your time 😉

As you are all aware we have an extensive directory that lists anyone from Painters to Civil Engineers and anyone in between, in other words – anyone that you will ever need in the construction, civil and mining industry…you’re welcome!

In amongst this vast array of professionals, vendors and contractors you get our Buyers.

Our Buyers are subscribed to our Leads 2 Quotes (L2Q) platform, aka The Pricing Platform. They use our directory to price their tender documents by sending out Request for Quotes (RfQ’s) and in turn, get to know and appoint sub-contractors for those specific contracts if and when they are awarded the contract.

On our directory, we also have our vendors who are active to receive the above referred to Request for Quotes (RfQ’s). You can be a non-paying Vendor or a paying Vendor (referred to as our Open Quotes Subscribers), both Vendor and Open Quotes subscribers will receive RfQ’s and will be able to price or decline online and view specifications or drawings should the contractor upload these.

The major benefit of being subscribed to Open Quotes is – that you will receive all award information for all Request for Quotes received! This gives you the opportunity to send your prices to the awarded contractor too! You will also be able to ensure that your directory entry is up to date to ensure that you receive the relevant Request for Quotes as well as ensuring that if anyone wanted to contact you that they could successfully.

So after some background information let’s move onto the tips on how you can improve your ranking on our directory. This just means that the better your company scores the higher it will rank in position on the list of companies (vendors or suppliers) our buyers see when they want to send out Request for Quotes (RfQ’s).

See tips below:

1) Just price the RfQ’s that you receive

When you receive an RFQ from a contractor please price it online or send it back via email and “reply all” on the email so we can get a copy and make sure that the positive response is entered into our system (the buyer can see this too).

2) Regularly Update the details on our database

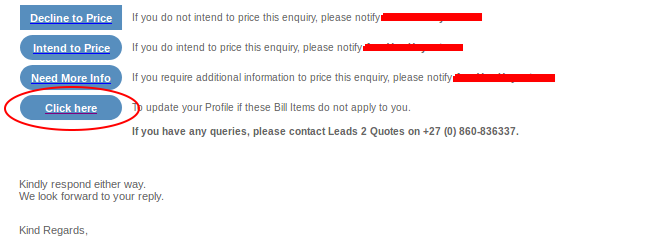

Even if there is nothing to change just ensure that we know that your details are still correct so we can go update it or mark it as still correct and this will help rank you higher, try do this every 3 months or so – if you are an Open Quotes subscriber you can do this from a link on the Request for Quote email you receive:

3) Subscribe to Open Quotes and we can help you get into contact with our buyers

The more contact you make with the buyers, whether it be sending through your prices or sending them your company profile or specials you may be running the more your company name will come up and you are more likely to be remembered and this could lead to your company becoming a preferred supplier/vendor of theirs and ultimately end up with your company ranking higher.

If you have any questions or would be interested in subscribing or updating your details, please send us an email on Directory@L2B.co.za and I will be happy to assist you.

Happy Pricing

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Events, please visit our Leads 2 Business Blog.

About Sally Nell

I joined Leads 2 Business in November 2011. I started in the Daily Tenders department and later moved to the Directory Department in May 2014.