Construction is a vital sector of any country’s economy because the physical construction of the developments become the backbone of the nation’s economy that enables goods and services to be distributed within and outside the country.

Furthermore, the functionality of the designs and construction of the developments have an impact on the productivity with which other business activities can be undertaken. Thus it can be said that the infrastructure of a country influences the competitiveness of enterprises and the country’s abilities to attract foreign investment, which is important in an era of globalisation as nations compete to attract foreign domestic investment.

However, with the general economic weaknesses Africa faces as a developing continent it means that we do not enjoy the realities of the above utopia.

Construction in Africa is predominantly funded through the following four Funding mechanisms

Government Funding

The Government is spending the “peoples money” to fund the project.

Private Funding

A project which is funded by a private developer which can be a private individual or company.

Loans

Financial assistance provided by an international bank or international financial institution to the government which is repayable after some time with interest. e.g. a loan from the African Development Bank or a generous loan from generous ‘ China ’

Public-Private Partnerships

A contract between a government institution and a private company, in which the private company bears significant risk and management responsibility, and payment is linked to performance.

Regional Construction Focus

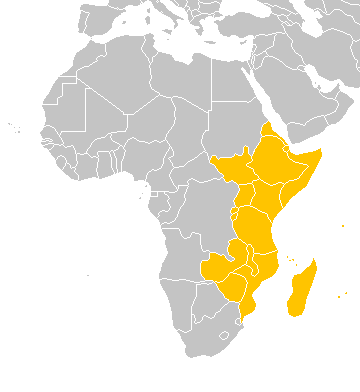

East Africa

With 166 underway projects on our website: East Africa accounts for 23.4% of projects on the continent.

Southern Africa

With 1229 underway projects on our website. The region accounts for 30.7% of all projects in Africa.

Central Africa

With 14 underway projects on our website. The region continues to be negatively affected by lower commodity prices, as all countries in the region are resource dependent. In total Central Africa is home to a few major public projects worth about US$9.8bn.

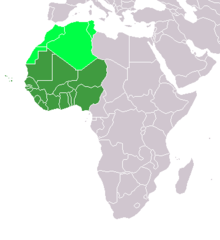

West Africa

With 66 underway projects on our website. The region accounts for 26.1% of all projects in Africa.

North Africa

With 50 underway projects on our website. The region accounts for 13.2% of all trackable projects on the continent.

Just taking into account the 1 525 projects that are marked as underway on our website out of the 6 412 captured,(with a cidb grading value 8-9. In stages between Conceptual – Underway) we can deduct that Africa requires an unprecedented magnitude of funds that individual countries do not have or just cannot afford to fully invest in. Furthering the dependency of international loans that we receive from the likes of China. This then minimizes the opportunities for local companies to make a sizeable splash in the construction pond.

The lack of funding or rather the ability for African nations to allocate more of their financial resources into construction has also cultivated a culture of non-payment of accounts. The amounts due to construction companies and a failure to make payment in time, lead to horrible liquidation or business rescue of established first-tier companies that boost the sector.

Furthermore due to the general economic weakness in the continent and a high need for infrastructure development means that we see more contracts that are uneconomical if work was to be given to local contracting professionals.

We further see delays in the completion of contracts within the scheduled times, if ever because of a lack of funds: which adversely affect the chances of any African nation attracting good and healthy direct foreign investment to boost the overall economy of the country. Furthermore, it affects local construction professionals because it becomes hard for them to afford to take the work.

Africa’s construction industry deficit is a cause of great distress. The problem of internal funding shortage and the large size of the infrastructure needs, require a lot of funding options. That we have! However, it would be great if we had ones that lessen the over-dependence on international loans because this allows excessive exposure and vulnerability of the continent and its resources.

Responsible lending and borrowing behaviour are required on the part of Africa and its development partners to avoid unsustainable external debt levels which are detrimental to Africa’s construction industry growth.

No matter what cause I pick for my topic, the prevalent effect seems to mimic a viscous airtime advance system cycle: You borrow airtime. Load airtime to pay back the service provider. Clear your debt. Be left with nothing. Then you have to borrow airtime again to survive and in the end, you have not looked after your own interests. In my opinion, the health and growth of the local construction scene by our own labour should be of main interest for the decision makers when funding the sector is concerned.

Concluding I have to admit, I would fail to propose a well developed, practically applicable solution model to the effects I have presented above. However as much as there are a whole lot of challenges surrounding construction operations in Africa, there is potential for growth. If we would just find suitable and positive investment strategies that will work for a developing continent, without harming the wealth of business knowledge, skills and labour we already have, in years to come the industry could be so well developed it would practically fund itself.

Sources:

George Ofori, Ph.D., D.Sc., Funding Construction Industry Development

Deloitte, Africa Construction Trend Reports

BDO South Africa, Saving the Construction Sector

African Business, Boosting development through sovereign wealth funds

Wikipedia

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

To view more Events, please visit our Leads 2 Business Blog.

About Minnie Zondi

I am an insanely optimistic ambivert that does everything from the heart instead of the mind. Deeply interested in people and matters that pertain to mankind.

Leave a Reply