Legendary Risk Solutions (Pty) Ltd is a market leader in the Construction and Plant insurance industry with over 15 years of Engineering Underwriting experience and customised insurance solutions and claims management.

Our specialised services and offerings are aligned with the highest of standards and we pride ourselves in our exceptional service deliveries. With the support of our expert and qualified staff, combined with our expanding infrastructure.

Legendary Risk Solutions (Pty) Ltd specialised product offering, offers you:

- Construction Related Guarantees

- Construction and Engineering Insurance

- Plant All Risk

- General Business Insurance

- Specialist Liability Cover

- Commercial Vehicle Insurance

- Specialist Liability Insurance

What is the most important insurance for Contractors/Subcontractors to consider?

Contract Works

This policy provides protection for Principals, Contractors and Sub-Contractors, covering construction projects, against physical loss or damage to the works during the construction phase. The projects can range from the construction of domestic dwellings, office blocks, water and sewer reticulation, roads, bridges or any other infrastructure development or process plants.

The policy can also provide protection for the Employers’/Contractors’ Legal Liability, in the event of injury or damage to third party persons or property, arising from the execution of the works.

Plant All Risks

This policy is designed to cover construction, mining and other mobile and non-mobile plant/machinery, against loss or damage whilst situated on-site or in transit to, or from the site. The cover can also apply to plant hired in or out by the employer and can cater for hiring costs following indemnifiable damage to the plant insured.

Machinery Breakdown

The Machinery Breakdown policy caters for sudden unforeseen physical damage to plant and machinery at the insured’s premises/factory. The cover includes damage resulting from dismantling and re-erection of machinery within the Insured’s premises.

The machinery can range from small refrigeration compressors and electrical motors to all types of machines used in mining, manufacturing and materials handling.

Loss of Profit

The policy caters for loss of Gross Profits or Increased Cost of Working (I.C.O.W.), resulting from a reduction in turnover following sudden unforeseen physical damage to plant and machinery covered under a Machinery Breakdown policy.

Deterioration of Stock

The policy is designed to cater for deterioration/spoilage of perishable goods held in cold storage facilities resulting from fluctuations in temperature caused by sudden unforeseen physical damage to machinery, such as the refrigeration plant, where cover is provided by a Machinery Breakdown policy.

Dismantling Transit and Erection (D.T.E.)

The Dismantling Transit and Erection policy provides cover for the movement of machinery between premises and includes the installation, as well as testing and commissioning of new machinery.

The cover can be extended to include Third Party Liability arising from the insured’s operations.

Works Damage

This policy is designed for the protection of manufacturers against damage to their products during the manufacturing process and or the property in the course of manufacturing arising from the impact caused by collision, dropping, swinging, overturning or collision at the manufacturer’s premises.

Computer and Electronics

The above policy provides cover for electronics equipment in its widest spectrum of use. The cover is on an “All Risks” basis, covering fire, theft, surge damage, malicious damage and electrical, mechanical derangement.

The equipment that can be covered by this policy ranges from P.C.’s (desktop computers) to medical apparatus, PABX’s (telephone exchanges), mainframes and laptops.

The policy can be extended to include Increased Cost of Working (I.C.O.W.) and Reinstatement of Data (R.O.D.).

How can companies get in touch with you?

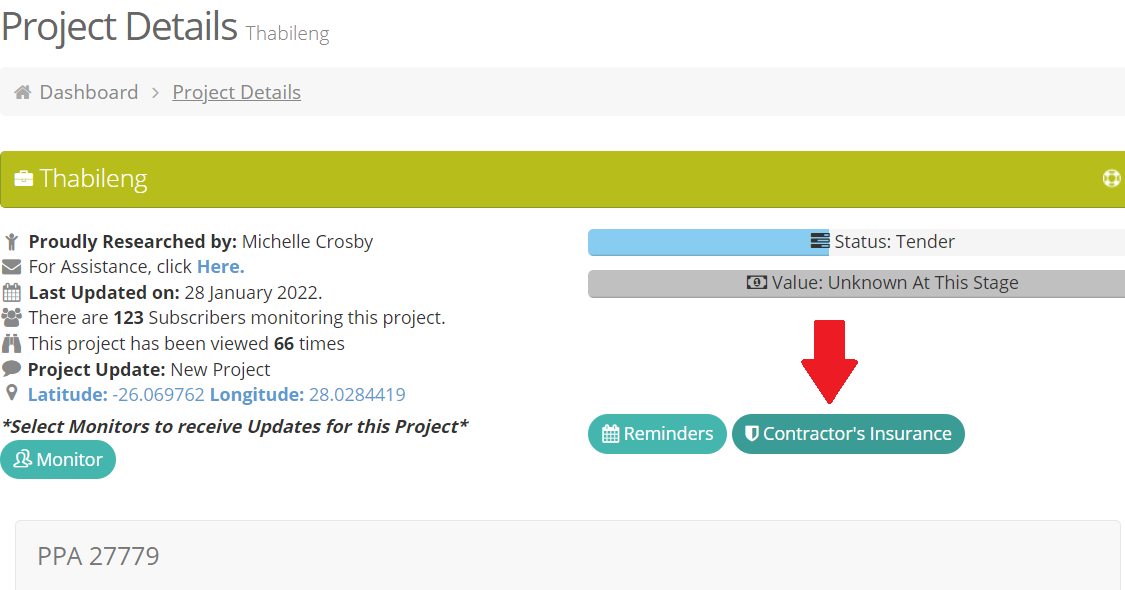

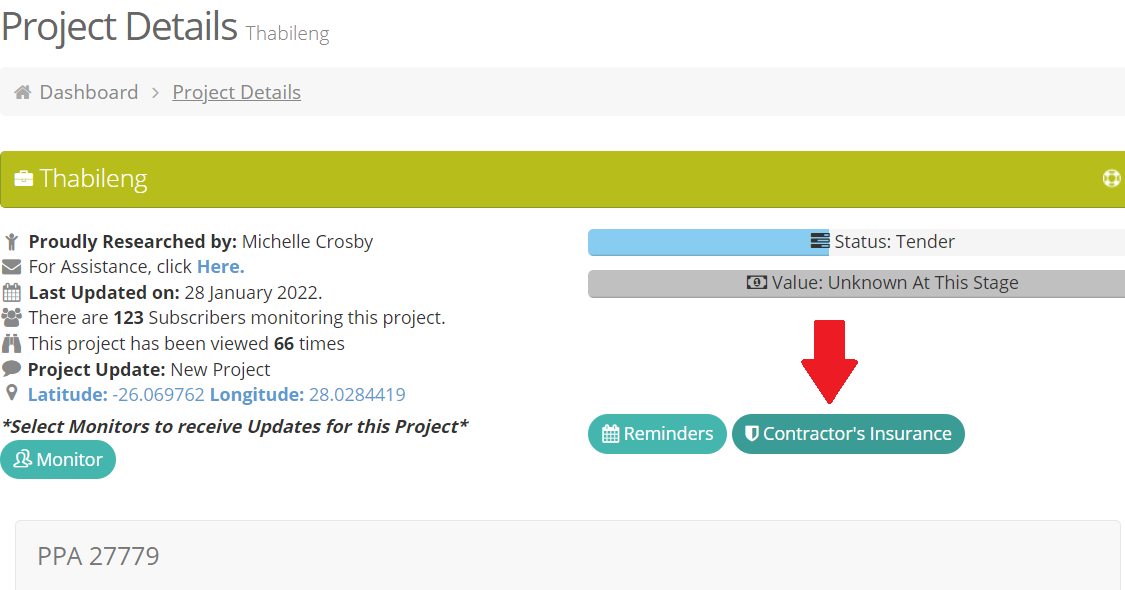

We are linked to all Projects & Tenders on Leads 2 Business. Simply click on the Contactors Insurance button and request a quote from us.

Alternatively, visit our website or contact us on 082 456 6541

To view more Articles, please visit our Leads 2 Business Blog.

If you are interested in becoming one of our subscribers, please visit Leads 2 Business.

To view notes with screenshots on how to use our website, please visit Leads 2 Business Wiki.

I started my journey with Leads 2 Business in 2013 as an Account Co-Ordinator. I transitioned into an External Sales position as an Account Executive in 2015. I help professionals within the building & construction industry keep up to date with the latest project and tender information as well as source new business opportunities throughout Africa.